chase heloc draw period

Bank of America Capital One Chase Citi and Discover. Learn more about the draw period.

Alliant Credit Union 2022 Home Equity Review Bankrate

10-Year HELOC Rates.

. A home equity line of credit HELOC can be a great way for homeowners to tap into their home equity for cash. During your 10-year draw period you can borrow as little or as much as you need up to your approved credit line. Interest-only payments during draw period.

You have the option to choose a minimum monthly payment of 1 or 2 of your outstanding balance though some may qualify to make interest-only. 3 With Aven you can get your card in just a few days in the mail you can use it any number of times for any amount under. OR b withdraw at least 30000 from their Chase home equity line of credit at closing.

If yours does not you can request a copy of your home equity line of credit statement by signing in to Online Banking going to the Help Support menu selecting. Depending on the terms the draw period or borrow period typically is the 10-year borrowing period during which you can access funds using your home equity line of credit. Home Equity Line Of Credit - HELOC.

Home Equity Line of Credit Lock Feature. Home equity line of credit HELOC. When that ends you have a repayment period of 10 to 20 years to pay off whatever amount you still owe in regular installments.

If you are not prepared for this then the. During the draw period youre only required to pay interest on the amount borrowed. However at the end of the draw period the interest and principal will be rolled into one amortized monthly payment for a loan term of 15 years.

Understand how the HELOC draw period works. However their loan officers were able to provide enough information without filling out an application that customers can get a good general sense of how much their home equity loan or. You may have up to five separate locks on a single HELOC account at one time.

Combined with their long history and branches in 41 states this makes Wells Fargo one of the best places to go if you are interested in obtaining a home equity line of credit. A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral. Home equity line of credit HELOC.

10 ways to get. With a home equity line of credit you have the total amount of your credit line but you draw from those funds on an as needed basis so you. A home equity line of credit is the most flexible type of home financing available.

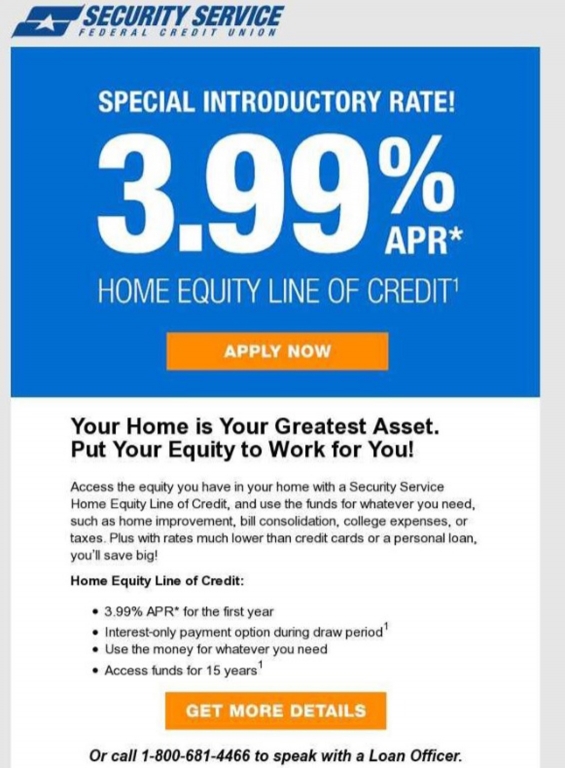

A home equity line of credit HELOC is like having a credit card backed by the equity in your home. However its also less predictable. The average interest rate on a 10-year HELOC is 399 the same as it was last week.

A HELOC can be more convenient than a home equity loan since you can tap into it for various projects throughout the draw period without having to apply for a new loan each time. How We Make Money. Make a financial plan for your HELOCs draw period and repayment period to avoid hurting your credit by missing payments.

A home equity line of credit works a bit differently. A lender provides you access to a line of credit based on. Todays rate is higher than the 52-week low of 255.

A home equity line of credit or HELOC ˈ h iː ˌ l ɒ k HEE-lok is a loan in which the lender agrees to lend a maximum amount within an agreed period called a term where the collateral is the borrowers equity in their house akin to a second mortgageBecause a home often is a consumers most valuable asset many homeowners use home equity credit lines only for. You can switch outstanding variable interest rate balances to a fixed rate during the draw period using the Chase Fixed Rate Lock Option. Borrowers are pre-approved for a.

There is no fee to switch to a fixed rate but there is a fee of 1 of the original lock. Its followed by the repayment period when interest and principal. Discount not available for existing HELOC customers with more than three 3 years remaining in the draw period.

Why not get a home equity line of credit instead. As with most home equity lines of credit Wells Fargo will charge interest during the draw period and you only have to pay on what you borrow. At the current interest rate a 25000 10-year HELOC would cost approximately 88 per month during the 10-year draw period.

Home equity lines of credit often come with high fees usually over 1000 minimum advances minimum credit limits often at least 50000 and take 4-6 weeks to close. Repay principal and interest. You will incur different fees based on the product that you select along with your repayment period draw period repayment structure and other considerations.

How Much Are Home Equity Loan Closing Costs Nextadvisor With Time

Tips To Help Financial Marketers Get More Home Equity Lending Business

Heloc Calculator How Much Could You Borrow Nerdwallet

Heloc Rates For May 18 2022 20 Year Heloc Rates Fall Forbes Advisor

/shutterstock_557631214.home.equity.heloc.cropped-5bfc30ff46e0fb00511aac29.jpg)

Is Interest On A Home Equity Line Of Credit Heloc Tax Deductible

How Much Are Home Equity Loan Closing Costs Nextadvisor With Time

Pay Off Your Mortgage Early Vs Investing Which Is Best Forbes Advisor

Does A Heloc Affect Your Credit Score Nextadvisor With Time

/33627666341_d037a66b41_k-35d77c8dbc624410b1617350bfb32138.jpg)

5 Ways A Home Equity Line Of Credit Heloc Can Hurt You

The Pros Cons Of Equity Loans And Helocs The Smart Investor

Does A Heloc Affect Your Credit Score Nextadvisor With Time

How Much Are Home Equity Loan Closing Costs Nextadvisor With Time

Heloc Rates For May 18 2022 20 Year Heloc Rates Fall Forbes Advisor

Home Equity Loan Oklahoma Near Me Line Of Credit Best Heloc Rates

What Is Revolving Debt Smartasset

Home Equity Loan Oklahoma Near Me Line Of Credit Best Heloc Rates

The Pros Cons Of Equity Loans And Helocs The Smart Investor

The Pros Cons Of Equity Loans And Helocs The Smart Investor

Home Equity Loan Oklahoma Near Me Line Of Credit Best Heloc Rates